According to research, the healthcare cost in the US reached $4.3 trillion in 2021. That comes to $12,900 per person.

Compared to other developed countries, the average healthcare cost per person is only half of that. These statistics make you realize how expensive medical treatment is in the US. What worsens this is that the US economy is going through a recession. The unemployment rate is increasing due to major sectors planning layoffs soon.

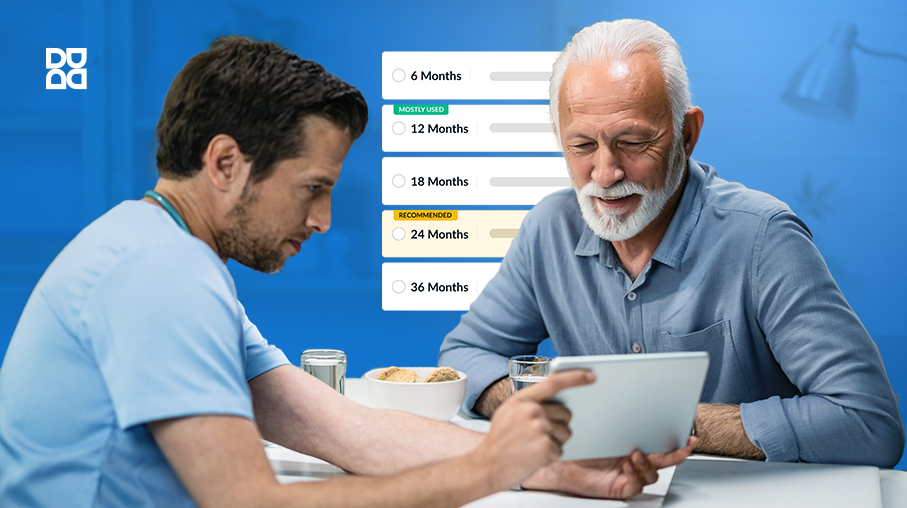

Boost Your Business Earnings with Our Easy-to-Use Payment Plan Software

So, what will Americans do to cope with this? They are already turning to companies that can help convert their bills into easy payment plans. Patients see these plans as good alternatives to medical credit cards. Americans are in massive debt. From student loans to mortgage payments, they have enough debt on their plate. That is why they prefer flexible payment plans instead of taking loans.

How Is Sunbit Helping Manage Medical Costs?

Sunbit allows patients to pay off their expenses through monthly payments. Patients can use it to pay for various medical treatments like dental care, eye care, and more. Sunbit has quickly become a good alternative to medical credit cards in the US. Also, people use Sunbit to pay off auto repair bills. They have tied up with over 20,000 merchants across America and have a 90% approval rate.

Sunbit also offers software for merchants to offer payment plans at checkout. It helps merchants convert more patients while helping make services affordable for consumers.

While Sunbit has many benefits for medical practices and patients, it also has some flaws. One of them is that patients have to undergo a soft credit check, leading to rejection for many. As we mentioned before, many Americans that need treatment these days have a bad or unfavorable credit score. That is the reason they turn to companies like Sunbit. So, a credit check defeats the whole purpose of payment plans for them.

So, for these reasons, there is a need in the market for an alternative to Sunbit. Here’s our list of the top three options.

Best Alternatives to Sunbit or Medical Credit Cards

Below are the details of the alternatives to Sunbit to offer flexible payment plans to customers.

1. Denefits

Denefits is one of the best alternatives to Sunbit. It is a healthcare payment plan solution that several medical practices already use. It allows patients to manage their medical bills with easy monthly payment plans.

Denefits helps ensure that medical practices can offer payment plans to more patients with its NO CREDIT CHECK POLICY. It means that more patients get approved quickly and without hassle.

Benefits to patients:

- 95% approval rate

- No credit checks

- Instant approval

- Easy monthly installments

Medical practices and businesses also enjoy several benefits with Denefits, including:

- Ability to offer custom payment plans

- Increased revenue

- Improved patient loyalty

- Protected payments to safeguard against missed or delayed payments

- Easy website & API integration

- Automated Debt Recovery

2. CarePayment

CarePayment offers payment solutions to medical practices, hospitals, and ancillary service providers. Their company helps patients pay off their medical bills with easy payment plans.

CarePayment helps patients reduce the burden of out-of-pocket expenses and high-interest rates.

The salient features of their services include:

- 0% APR

- Low monthly payments

- Flexible payment terms

- No impact on your credit score

CarePayment is available at over 2000 locations across the US. They have a vast network of providers that you can choose from.

Here are some ways in which CarePayment helps medical practices:

- Improved patient experience

- Increased ROI

- Helps in collecting missed payments

Even though CarePayment is a good Sunbit alternative,, they have limited availability. If we compare them with Sunbit or other payment plan providers, they still have a lot of ground to cover.

3. Afterpay

Businesses use Afterpay as a Sunbit competitor across various industries like retail, automotive, and others besides healthcare. Their solution helps patients pay their bills by converting them into four payments. Patients can pay off the amount over six weeks. However, you must make the first of the four payments upfront.

As long as patients pay off the amount within the given time frame, they pay no interest. Afterpay reportedly has over 19 million users at present. Merchants use it globally to allow customers to pay for their services easily. Afterpay works both online as well as in brick-and-mortar locations.

Afterpay’s benefits for users include the following:

- Interest-free payment opportunity

- Convert bills into easy installments

- Use for online & offline payments

Afterpay also offers various benefits to merchants. These include:

- Increase in average order value (AOV)

- Increase in the frequency of payments

- Integrates with various systems

- You can use it on a website, app, or physical location

While this company offers easy payment options, an upfront payment is necessary. Also, the interest-free payments are only valid if you make payments over six weeks. Any payment plan for a longer duration includes interest.

A Brief Comparison Between Sunbit, Denefits, Carepayments, & Afterpay

| Factors | Sunbit | Denefits | CarePayment | Afterpay |

|---|---|---|---|---|

| Services | Provides financial technology payment tools | Offers Flexible Payment Options | Customer Financing | BNPL services |

| Approval Rate | 90% | 95% | No Application Required | 73% or less |

| Monthly Payments | Easy monthly payments | Flexible payment plans | Low Monthly Installments | Fixed Installments |

| Merchant Partnerships | Partnered with 20,000+ merchants | Trusted by 10K+ Businesses | Available at over 2000 locations | Used globally across industries |

| Interest | Varies | Deferred interest options and lower interest rates | 0% APR | Interest-free payments for six weeks |

| Credit Checks | Soft Credit Check | No Credit Checks | No Impact on credit scores | Soft Credit Check |

| System Integration | API integration available | Web Integration and API Integration Available | Available | Integrates with various systems |

| Approvals | Instant approval | Instant approvals | No application or credit approval required | Quick Approval |

| Additional Information | ▪️ Protected payments ▪️ Automated Debt recovery ▪️ Customization Options ▪️ Multi-language support | ▪️ Interest-free option only for 4–6 weeks and standard interest applies for longer plans |

Conclusion

Choosing the right payment plan solution can help reduce the burden of expensive medical treatments for your patients. Additionally, it helps ensure steady revenue for medical practices. We hope the information in this post helps you determine the payment plan software for you.

Among the above options, Denefits stands out as the best alternative to Sunbit with its unmatched flexibility, ‘NO CREDIT CHECKS’ policy, and protected payments against delayed and missed payments.