If you're worried about your accounts receivable numbers, you're not the only one feeling that way.

| According to the 2022 Atradius Payment Barometer, half of all business invoices generated in the U.S. were subject to late payments. Additionally, 42% of surveyed companies reported spending more time recovering past-due accounts, indicating an increase from the previous year. |

These statistics are alarming and can significantly impact the bottom line of many businesses. But why do these issues arise, and why are businesses unable to recover such accounts?

| In this blog, we will discuss: ➡️Setbacks businesses face due to past-due accounts and the reasons behind them. ➡️Existing debt recovery options and their shortcomings. ➡️Debt collection automation. ➡️Denefits, an automated debt collection software. |

Discover the Benefits of Our Payment Plan Software to Enhance Your Business Revenue

Challenges Businesses Face Due to Overdue Accounts

- Accumulated debts strain cash flow, hindering daily operations and limiting growth opportunities.

- Debt hinders investment in crucial areas, like research, development, and technology upgrades.

- High debts may force cost-cutting measures, impacting employee benefits and overall operational efficiency.

- A substantial amount of debt can damage investor and customer perceptions, eroding trust and loyalty.

- Debt obligations limit financial flexibility, posting challenges during economic downturns or market shifts.

- Notably, excessive debts elevate the risk of default, leading to legal actions, asset seizures, and potential bankruptcy.

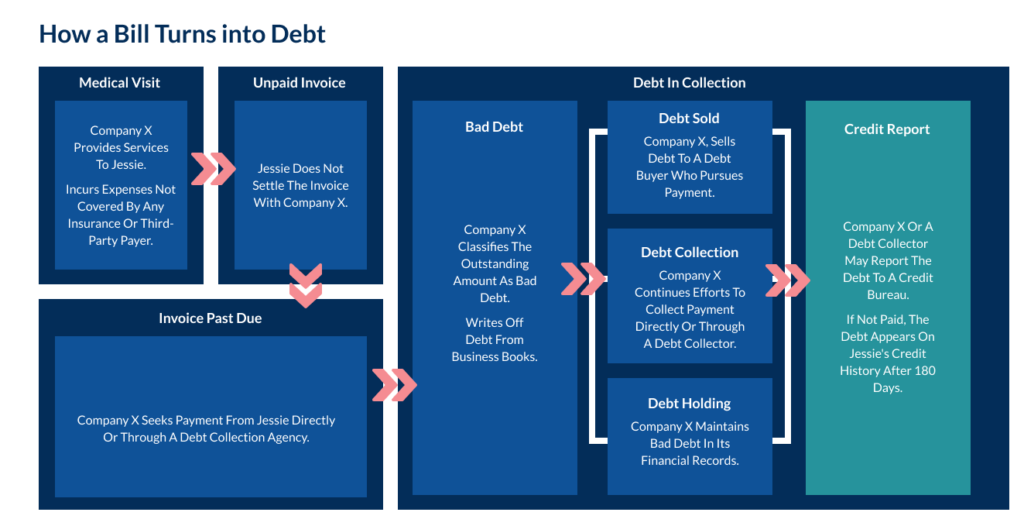

How Bills Turn Into Bad Debt

Manual Debt Collection Alternatives: In-House Collections & Collection Agencies

Overdue accounts often leave businesses with no other option than to resort to assertive collection measures. Typically, there are two ways of doing so - managing in-house collections or employing collection agencies. Let’s discuss these two widely used measures in detail.

| Aspect | In-House Collections | Collection Agencies |

|---|---|---|

| Operational Control | Direct control by the creditor. | Third-party entities handle the process. |

| Customer Relationship Impact | May strain customer relations due to direct interactions and potential adversarial situations. | External agents may be perceived as more impersonal, reducing direct friction with the debtor. |

| Flexibility in Approach | More adaptable to tailor approaches based on individual customer circumstances. | Follow standard industry practices, may lack flexibility in negotiations. |

| Costs | Typically lower operational costs, but potential hidden costs in terms of employee training and technology. | Charge fees, often contingency-based, which means they receive a percentage of the recovered amount. |

| Employee Expertise | In-house staff may have a deeper understanding of the company's products/services and customer base. | Collection agencies specialize in debt recovery, often with extensive industry knowledge. |

| Scalability | May struggle with scalability during peak times. | Typically more scalable, equipped to handle varying volumes of accounts. |

| Time and Resources | In-house collections may divert resources from core business functions. | Outsourcing allows the business to focus on its core competencies. |

| Success Rates | Success rates can be influenced by the in-depth knowledge of customer history. | Specialized agencies may have higher success rates due to expertise and experience. |

| Costs for Debtor | In-house collections may offer more flexible repayment options for debtors. | Collection agencies may charge additional fees, potentially increasing the overall debt for the debtor. |

Common Setbacks of Manual Debt Collection

- Manual check-based collections lead to cash flow fluctuations, impacting business stability.

- Aggressive follow-ups strain customer relationships risking negative brand reputation and affecting patient trust.

- Unsuccessful collections result in bad debt write-offs, affecting the bottom line.

- Manual AR management poses a higher risk of human errors, urging digitization adoption.

- Time-consuming follow-ups frustrate staff members, affecting workplace morale.

Although businesses may be able to recover overdue accounts using these practices, it may do more harm than good in the long run, considering their aggressive nature, lack of effectiveness, and uncertain outcomes. Nevertheless, what other option is there? Well, automated debt collection seems to pose an answer to this long-asked question. Let’s learn more about automated debt collection technology and how Denefits is leading the way as an automated debt collection software with its Accounts Receivable feature.

Denefits’ Accounts Receivable (AR): Bringing in Automated Debt Collection

To address the growing challenge of overdue accounts and their impact on businesses' bottom line, Denefits has seamlessly integrated automation into the debt collection process, ensuring minimal human intervention and maximum impact. How? Enter- Denefits Accounts Receivable (AR). This powerful feature entails everything you need to streamline and automate debt collection. Broadly, it involves sending automated persuasive messages offering flexible payment options to engage customers and encourage timely payments. Further, given the convenience of choosing a flexible payment plan option, customers are more likely to comply. Moreover, this boosts repayment rates and progressively reduces outstanding accounts.

All in all, Denefits, with its Accounts Receivable feature, is an ideal automated debt collection software that not only streamlines the debt collection process but also optimizes overall financial operations. With that said, its implementation translates to improved efficiency, providing businesses with a simple yet powerful solution to navigate and overcome the challenges posed by overdue accounts.

Automated Debt Collection, As Easy as It Gets

| 74% of the businesses successfully recovered their bad debt and on average collected $52,912 in just 3 months with Denefits’ AR. |

▶️Upload Past-Due Accounts:

Easily submit a list of overdue accounts to Denefits, streamlining the debt-recovery process.

▶️Automated Reminders and Payment Options:

Send impactful reminders and provide diverse payment options to customers. These options may include paying the balance at once, partial payments, or enrolling in a convenient payment plan.

▶️Flexible Payment Plans:

Customers can conveniently choose a payment plan aligning with their budget, increasing the likelihood of timely installment payments.

▶️Recurring Payments:

Receive regular payments as customers start fulfilling their obligations through the chosen payment plan.

▶️Efficient Management and Reporting:

Access comprehensive reports for a clear overview of the debt collection status.

Benefits of Automated Debt Collection through Denefits’ Accounts Receivable (AR)

- Add multiple past-due accounts at once, eliminating the need for individual follow-ups.

- Send gentle yet persuasive reminders to patients, avoiding spam and encouraging timely payments.

- Offer flexible payment plans, increasing the likelihood of on-time bill payments.

- Access recovered and pending accounts in a simple dashboard, eliminating the need for multiple systems.

- Relieve staff from the hassle of contacting debtors, reducing administrative frustrations.

- Automated debt collection minimizes manual errors.

- Flexible installment options reduce bad debt write-offs, fostering a steady income stream.

- Non-intrusive text reminders for effective communication, enhancing recovery rates.

- Communicating with clients in their preferred language inspires trust.

Denefits’ Accounts Receivable Vs. In-House Collections Vs. Collection Agencies

Does automated debt collection really work? Is automated debt collection technology better than traditional collection methods? Let’s look at the comparative table below for a better understanding.

| Aspect | In-House Collections | Collection Agencies | Denefits’ Accounts Receivable |

|---|---|---|---|

| Operational Control | Direct control by the creditor. | Third-party entities handle the process. | Automated debt collection controlled by the user. |

| Customer Relationship Impact | May strain customer relations due to direct and potentially aggressive interactions. | External agents may be perceived as impersonal, affecting customer perception. | Uses automated, friendly, and persuasive reminders to maintain a positive customer experience. |

| Costs | Lower operational costs but potential hidden costs. | Charge fees, often contingency-based. | Initial investment in software, potentially lower than agency fees, with ongoing operational efficiency. |

| Employee Expertise | In-house staff may have a deep understanding of the company and customers. | Collection agencies specialize in debt recovery, with industry knowledge. | Relies on software capabilities; reduces the need for specialized staff. |

| Scalability | May struggle with scalability during peak times. | Typically more scalable, equipped for varying volumes. | Offers scalability through automation; can handle multiple accounts efficiently. |

| Legal Compliance | Easier to ensure compliance with regulations and policies. | Agencies need to adhere to legal guidelines. | Designed to comply with legal requirements, reducing risks. |

| Costs for Debtor | May offer more flexible repayment options. | Agencies may charge additional fees, potentially increasing the overall debt. | Offers various payment options, making it comfortable for debtors, and potentially reducing overall debt. |

| Communication Approach | Direct communication may lack personalization. | Agencies often use standardized methods. | Automated, persuasive reminders tailored to maintain positive communication. |

| Efficiency and Error Reduction | May experience human errors and delays in manual processes. | Agencies aim for efficiency but may still encounter errors. | Automated processes minimize errors, enhancing overall efficiency. |

| Financial Stability | Struggles may impact financial stability. | Outsourcing can contribute to a steady income. | Enhances financial stability by reducing the likelihood of bad debt write-offs. |

| Integration of Technology | Relies on traditional methods, potentially prone to delays. | Relies on technology but may still face challenges. | Leverages advanced software capabilities for efficient automation. |

| Multilingual Support | Dependent on staff language skills. | May have language support limitations. | Offers multilingual support, enhancing communication. |

| Ease of Use and Management | Manual process may be cumbersome and time-consuming. | Requires coordination with external entities. | User-friendly software with a simple dashboard for efficient management. |

| Overall Efficiency and Benefits | Traditional but may have drawbacks. | Effective but may come with costs. | Streamlines debt recovery, offers flexibility, reduces costs, and improves overall efficiency. |

Denefits' AR employs automated debt collection technology most powerfully, and that's what sets it apart. Moreover, this debt collection automation not only saves time and effort but also protects payments that are either delayed or missed. Thus, significantly increasing the chances of successful debt recovery.

Furthermore, businesses get access to real-time insights which encourages informed decision-making, and prompt and proactive debt management. That's not all, Denefits' Accounts Receivable feature allows you to do all that while maintaining positive customer relationships. Eventually, all of this translates to improved cash flow, financial success, and a better business reputation.

Conclusion

Overdue accounts pose a grave challenge for businesses across industries, directly affecting their bottom line. Fortunately, they can be tackled by adopting automated debt collection technology. Denefits, leading the way with its Accounts Receivable feature, makes automated debt collection as easy and effective as it gets. No more spending hours on end trying to get your customers to pay what they owe you. Simply add all overdue accounts to Denefits' AR, offer them the convenience to pay as they prefer, and receive your rightful payments, even if over time.

Struggling with delayed payments or simply want to set up a systematic debt collection process without putting your customer relationships at stake? Book a Demo and experience the effectiveness of debt collection automation with Denefits firsthand.