The cost of healthcare in the United States is a pressing concern for patients. It's not just a matter of money; it's also affecting their well-being.

A recent report revealed that 23% of Americans have medical debt and struggle to pay bills. As a result, many people delay/avoid seeking the necessary medical treatments.

But, there is a solution that can ease their financial burden-patient payment plans. Many people look for healthcare providers offering affordable payment options as it allows them to get necessary medical care without disrupting their budget.

Custom API Integration: Enhance and Grow Your Business with API

Website API integration can make your business operations more efficient and user-friendly. Get up to speed here!

This blog can help you understand the impact of rising healthcare costs on patients and what you can do to decrease their burden.

Why Is Healthcare Becoming So Expensive in the U.S.?

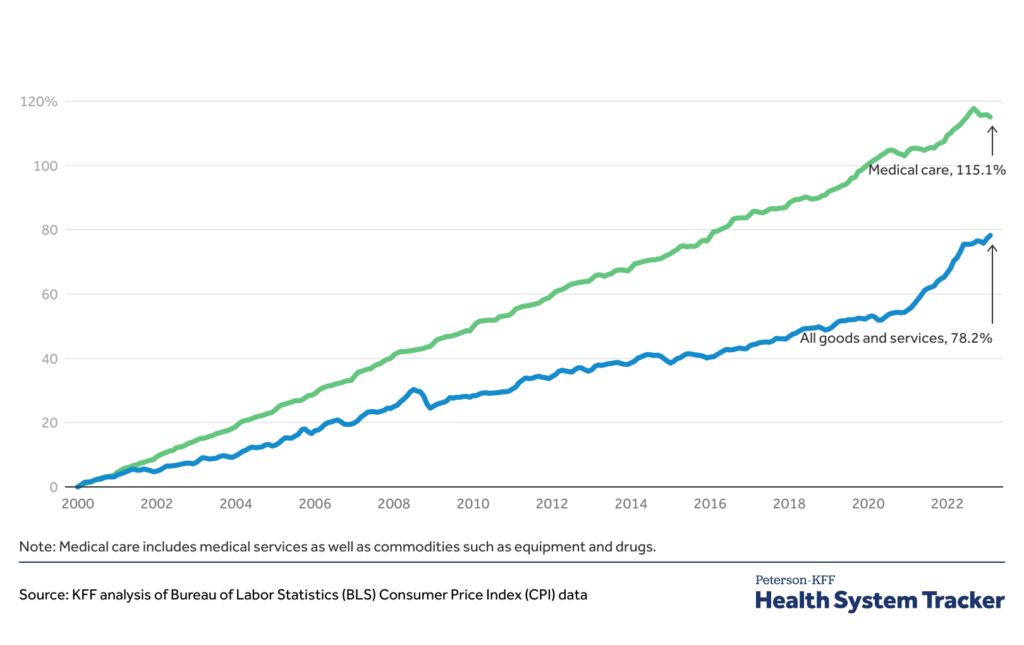

As inflation rises, prices for medical care are increasing much more quickly. Here are a few critical causes of inflating healthcare costs:

- Cost of advanced medical technologies

- Rising drug prices

- Administrative costs

- Lack of proper insurance coverage

- The rising cost of living

Cumulative percent change in Consumer Price Index for All Urban Consumers (CPI-U) for medical care and for all goods and services, January 2000 - February 2023

How Does It Impact Patients?

Every American faces the effects of rising healthcare prices. But, low-income patients are the most affected. The high medical bills impact their financial and physical well-being in the following ways:

1. Skip Out on Preventive Care:

Many patients in the U.S. suffer from chronic conditions (i.e., diabetes, heart disease, high blood pressure). Preventative care can help detect and stop these conditions in their early stages.

But people often skip check-ups due to high costs. It often leads to more expensive medical issues later.

2. Cutting Household Expenses:

Most patients in the U.S. have health insurance from private insurance providers. Some patients even spend out-of-pocket on health-related expenses due to a lack of proper coverage.

So, they must choose between cutting household expenses and paying medical bills.

3. Healthcare Debt:

About 4 in 10 adults have accumulated healthcare debt due to medical or dental bills. It includes medical loans, credit card bills, and debt from traditional lenders. Hence, paying for healthcare is becoming more challenging for most Americans.

How Can Healthcare Providers Help?

As a healthcare provider, here’s how you can ensure that people can easily access your services:

1. Understand Patient Needs:

First, you should understand the needs of your patients in a poor financial situation. Most of these patients may be unable to pay instantly. To help, you should offer flexible payment plans for medical bills.

2. Use Payment Plans Software:

You can integrate Denefits, a payment plan management software. It lets you instantly create payment plans that suit your and your patient’s needs.

By offering payment plans, you allow your patients to pay in small installments that fit into their budget easily. The software automates the payment process so you can focus on treating more patients.

3. Customize Payment Options to Meet Patient Needs:

With the Denefits software, you can customize the payment plans. For example, you can adjust the payment term (i.e., 6, 8, or 12 months) and frequency of payments (weekly, bi-weekly, or monthly).

It can help your patients pay for their medical expenses without breaking the bank. Moreover, it will ease their mental stress and anxiety.

What Are the Benefits of Offering Payment Plans?

(a) Reduce Patient Anxiety and Stress

Patients often experience anxiety and stress when they can't afford medical expenses. Unpaid bills harm their credit scores, which makes them avoid getting the help they need.

However, offering payment plans demonstrates your commitment to your patient's well-being. It allows them to manage their medical bills within their budget. You can convert more patients who otherwise cannot afford their treatment.

(b) Promote Access to Timely Healthcare Services

When you offer affordable payment options, patients are likelier to come to you. Thus, it improves their access to timely healthcare services, promoting better health.

Also, it can help extend your services to patients from all income groups, boosting sales.

(c) Enjoy Better Financial Stability

Payment plans offer flexibility to pay for medical expenses periodically. They help reduce the immediate financial strain on patients. But, at the same time, you can enjoy recurring payments. Hence, offering payment plans can help improve your financial stability over time.

(d) Boost Patient Satisfaction and Loyalty

Providing affordable payment plans to customer enhances patient satisfaction. And satisfied patients are more likely to remain loyal, promoting long-term relationships.

Conclusion

Medical care has become more expensive in recent years. However, offering payment plans is a great way to help ease the financial burden of patients.

You can improve your reputation and revenue by incorporating payment plan software into your existing system. The flexibility to pay can help more patients get quality care.

So, take a step towards making healthcare affordable by using Denefits. Enjoy recurring revenue while fostering trusting relationships with your patients.

Schedule a demo to get started!